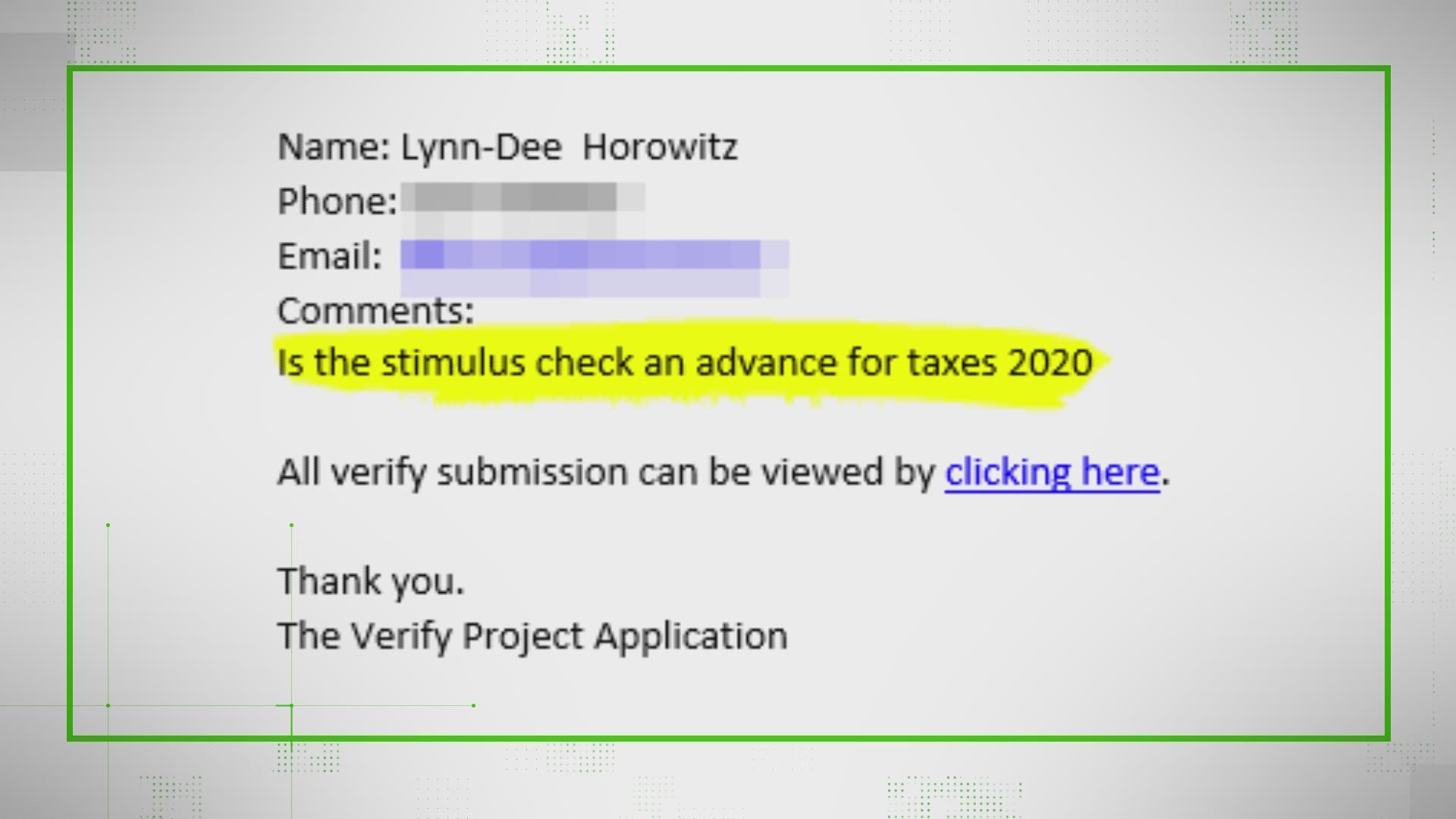

cares act stimulus check tax refund

The CARES Act stimulus check expats got in 2020 was technically a 2020 tax credit in advance. Under the law the Fund is to be used to make payments for specified uses to States and certain local governments.

How To Claim A Missing Stimulus Check

Married taxpayers will get 2400.

. Many Americans are feeling the impact of the COVID-19 pandemic on their everyday lives. Up to 75000 if single or you filed taxes married filing separately. The Treasury Department and the Internal Revenue Service today announced that distribution of Economic.

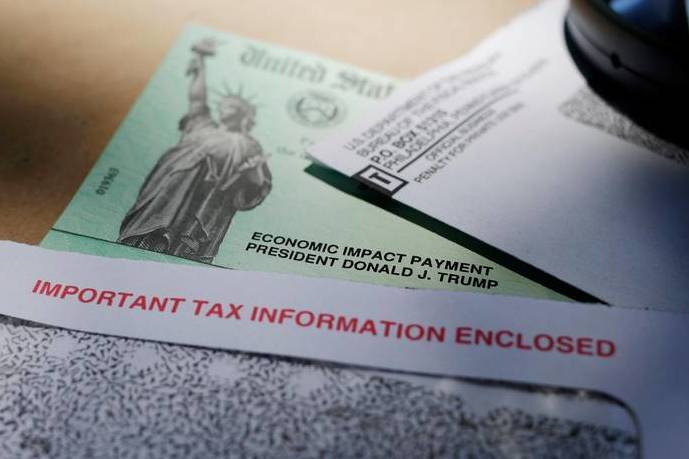

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. A payment also will not affect income for purposes of determining. As part of the Coronavirus Aid Relief and Economic Security Act or CARES Act Uncle Sam is sending stimulus checks to millions of.

As part of the Coronavirus Aid Relief and Economic Security Act or CARES Act Uncle Sam is sending stimulus checks to millions of Americans. Employee Retention Credit ERC The ERC was designed to help keep employees on the job by allowing business owners to claim a payroll tax credit. As a result to COVID-19 the Federal Government is taking action to ease the burden to taxpayers by passing the Coronavirus Aid Relief and Economic Security Act HR 748 also known as the CARES Act.

COVID-19 Stimulus Checks for Individuals. And for each child under the age of 17 parents will get 500. The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund.

1400 in March 2021. This will have an adverse effect on taxpayers who earned high incomes in 2018 or 2019 but. As a result of the CARES Act which became law on March 27 2020 most Americans will receive stimulus checks.

However there may still be people eligible for those checks or. 1200 in April 2020. 1400 in March 2021.

Up to 112500 if you filed as head of household. Yes the one-time stimulus payments stemming from the CARES Act are technically advanced refunds on a tax credit that qualifying taxpayers will receive for 2020. That basically just.

These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. The federal Coronavirus Aid Relief and Economic Security Act CARES ACT Consolidated Appropriations Act 2021 and American Rescue Plan Act of 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and provide assistance to taxpayers and businesses affected. The latest round of stimulus checks will allow people to use the later of their 2019 or 2020 tax data file your tax return via TurboTax to ensure the latest dependent and payment information can be usedFurther the new legislation has expanded the.

But thanks to the Families First Coronavirus Response Act FFCRA and the Coronavirus Aid Relief and Economic Security CARES Act you might see some relief when you file your 2020 taxes taxes filed in 2021. The Advanced Child Tax Credit payments authorized by the American Rescue Plan Act are not subject to offset for any reason through the Treasury Offset Program TOP. It was part of the CARES Act Coronavirus stimulus package which was designed to help get the economy back on its feet while we navigate the COVID-19 pandemic.

Tax Return for 2020. Updated April 16 2020 as a result of new information available. We break down the major changes that could impact.

The CARES Act stimulus check expats got in 2020 was technically a 2020 tax credit in advance. In some cases these monthly payments will be made beginning July 15 2021 and through December 2021. Single taxpayers will get 1200.

The government has deployed most of the third round of stimulus checks in amounts of up to 1400 per person. The money will be paid out based on 2019 taxes or. The IRS says it is no longer deploying 1400 stimulus checks and plus-up payments that were due to qualifying Americans in 2021.

600 in December 2020January 2021. COVID-19 Stimulus Checks for Individuals. The money will be paid out based on 2019 taxes or if 2019 taxes have not been filed yet on 2018 taxes.

Tax Return for 2020. In the somewhat longer words of the IRS. The District of Columbia and US.

Territories consisting of the. The short answer. IRS has prepared frequently asked questions FAQs to address debtor.

The payment will not reduce a taxpayers refund or increase the amount they owe when they file their 2020 or 2021 tax return next year. Posted on April 16 2020. If you owe 1500 in federal income taxes and you get a 1000 tax credit your tax bill sinks to 500.

Stimulus Check Information - CARES Act. The CARES Act gave a maximum 1200 per person. It was part of the CARES Act Coronavirus stimulus package which was designed to help get the economy back on its feet while we navigate the COVID-19 pandemic.

If youre looking to get your stimulus funds -- called economic impact payments -- quickly you need to verify that the IRS has your most recent bank information or address on file so it can deposit your funds promptly. What did the CARES Act 2020 Coronavirus stimulus check mean for US. Married taxpayers will get 2400.

Because business owners claim it on their quarterly employment tax return Form 941 the CARES Act benefit isnt reported on their income taxes for their business. Up to 150000 if married and you filed a joint tax return. You are eligible to get a stimulus check and will receive the FULL amount if you filed taxes and have an adjusted gross income of.

2021 Third Stimulus Check Income Qualification and Phase-out Thresholds Limits Expanding Dependent Eligibility. -- Review your most recent tax return. No the payment is not income and taxpayers will not owe tax on it.

Irs Starts Sending Last Stimulus Check Americans Expected To Receive More Money The Republic Monitor

Will The Stimulus Money Be Deducted From Your Refund Next Year 9news Com

Stimulus Check Status Update Irs Payment Timeline What To Know About Plus Up Money Irs Prepaid Debit Cards Filing Taxes

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Eip Card Stimulus Check Can I Transfer It To My Bank Account Everything You Need To Know How To Get Money How To Find Out Visa Debit Card

All Stimulus Checks Have Been Sent I R S Says The New York Times

Child Tax Credit And 3rd Stimulus Watch For These Irs Letters 11alive Com

How The Recent Stimulus Checks Affect Your Ssdi Benefits Call Sam

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Stimulus Check Petition Seeking 2 000 Monthly Payments Hits 2 5m Signatures Mlive Com

Third Stimulus Check When Could You Get A 1 400 Check In 2021 Irs Money Sign Prepaid Debit Cards

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

Stimulus Checks Tax Returns 2021

How To Get A College Student Stimulus Check 2022

Many Americans Will Receive 1 200 Payments From The Irs And Many Have Questions About The Motley Fool Debt Money

3rd Stimulus Check Tax Filing Impact The Child Tax Credit And Other Faqs Abc7 Chicago

What 2022 Means For Stimulus Checks And The Child Tax Credit Gobankingrates